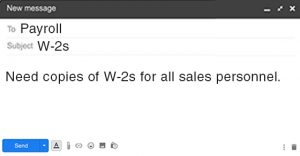

National Tax Security Awareness Week ends Dec. 4, but the IRS and its security partners urge taxpayers to remain vigilant. A common scam aimed at employers is W-2 theft, according to the IRS. The most common version of this scam is when a thief posing as a high-level manager sends an e-mail request to a payroll dept., seeking a list of employees and their W-2s. The scam may go undetected until fraudulent returns are filed in the employees’ names. If your company is victimized by this scam, contact the IRS immediately. If notified quickly, the IRS may be able to help protect employees from tax-related identity theft. Here’s how to report the scam to the tax agency. Contact Cg for more information. © 2020