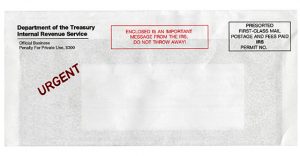

While receiving mail from the IRS typically isn’t cause for panic, it shouldn’t be ignored either. The IRS mails a letter or notice if the agency needs to ask a question about your tax return, notify you about a change to your account, or request a payment. Each notice deals with a specific issue and includes instructions on what to do. Taking timely action could minimize additional interest and penalty charges. If you receive a letter from the IRS, contact us. We can help determine what your next steps should be. Click here for additional information. © 2022