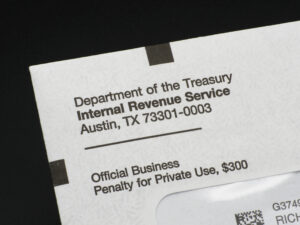

Receiving a letter from the IRS may make you go weak in the knees. Don’t panic, but do read the letter, the tax agency says. The IRS may simply have a question about your return or inform you of a change to your account or the letter may request payment. Don’t ignore it. Instead, read it carefully, right away. Most IRS communication deals with a specific issue and prompt action could minimize any extra charges. If you owe more tax and you’re struggling to pay it, several options are available. Only reply if the letter instructs you to do so. If you dispute the IRS findings, the letter will likely instruct you how to proceed. Here’s more: https://bit.ly/4d3BTdD. Contact us with questions. © 2024